ALLOW LIBERAL IMPORT OF OIL SEEDS

FINACIAL EXPRESS 11.02.2015

FINACIAL EXPRESS 11.02.2015

“MAKE EDIBLE OILS IN INDIA” BY FREELY ALLOWING

IMPORT OF OILSEEDS

LET NITI AAYOG TAKE

THIS STRATEGIC AGRO- INITIATIVE

Tejinder Narang

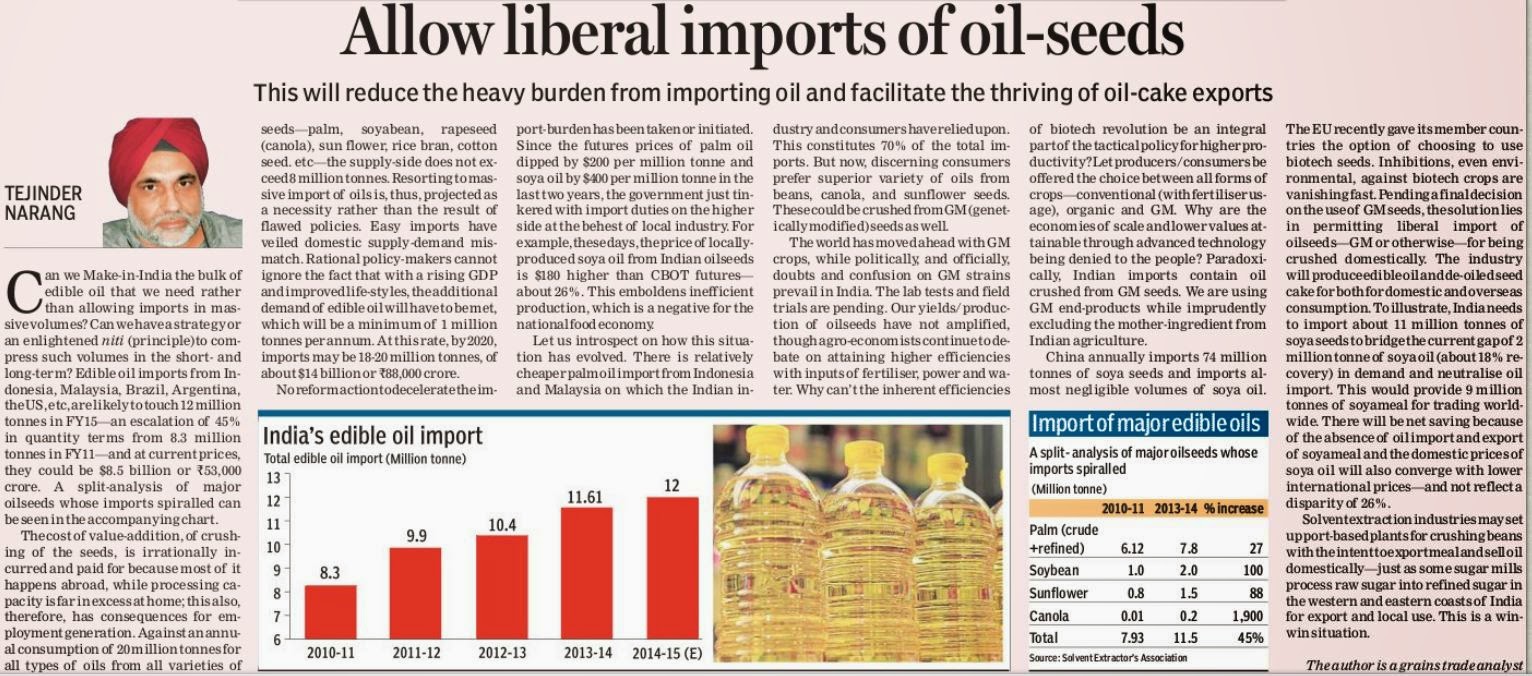

Can we “Make in India” bulk of

edible oil rather than allowing its gargantuan import? Can we have a strategy

or an enlightened “Niti” to compress such volumes on short and long term? Edible oil imports from Indonesia, Malaysia,

Brazil, Argentina, USA etc. are moving up to 12 million tons in 2014-15—an

escalation of 45% in quantity terms from 8.3 million tons since 2010- 11-- and

at current prices they could be $8.5 billion or Rs 53000 crores.

(Chart 1)

( Source-Solvent Extractor’s

Association)

A split- analysis of major

oilseeds whose imports spiralled can be seen in chart2

Chart2.

(Source-Solvent Extractor’s

Association)

The “value addition” for crushing

most of the seeds abroad is irrationally incurred and paid, while there is far

in excess processing capacity at home for employment generation and demand

satiation. Against annual consumption of

20 million tons for all types of oils from all varieties of seeds- palm ,soybean,

rapeseed (canola), sun flower, rice bran, cotton seed etc., supply side does

not exceed 8 million tons. Resorting to massive import of oils is thus

projected as a necessity rather than resultant conclusion of flawed policies. Easy

imports have veiled domestic supply demand mismatch. Rational policymakers cannot

ignore the fact that with rising GDP and improved life styles, additional

demand of edible oil will have to be met which will be minimum 1million tons

per annum. At this rate by 2020, imports may be 18-20 million tons or about $14

billion eq. to Rs 88000 crores.

No reformist action to decelerate import pull

has been taken or initiated. Since

futures’ prices of palm oil dipped by $200pmt and soy oil by $400pmt in last

two years, Government just tinkered with import duties on the higher side at

the behest of local industry. For example, these days price of locally

produced soy oil from Indian oilseeds are $ 180 higher than CBOT futures—about

26% (see chart3). This emboldens inefficient production which is negative for

the national food economy.

Chart 3

(Source—Sopa Nov prices

&CBOT)

Let us introspect how this

situation has evolved. There is a relatively cheaper palm oil imports from

Indonesia and Malaysia on which Indian industry and consumers have relied upon.

This constitutes 70% of total imports. But now discerning consumers prefer

superior variety of oils from beans, canola, and sunflower oil. These could be crushed from GM (genetically

modified) seeds as well.

The world has moved ahead with GM

crops, while politically and officially doubts and confusion on GM varieties

prevails in India. Lab tests and field trials are pending. Our yields/ production of oilseeds have not amplified, though agro-economists

continue to debate on attaining higher efficiencies with inputs of fertilizer,

power and water. Why inherent

efficiencies of bio tech revolution cannot be an integral part of the “Niti”—a tactical

policy for higher productivity? Let producers/ consumers be offered choices

of all forms of crops—conventional (with

fertilizer usage) or organic or GM. Why economies of scale and lower values

attainable by end use of advancement of technology are being denied? The Prime Minister too have repeatedly urged

for transferring of abundance of “Lab” research to the “Land” for

transformation of Indian agro potential.

Then why the issue is being ducked?

Yet, paradoxically, Indian trade

imports edible oil crushed from GM seeds.

Its consumption is allowed freely. We are using GM end products while

imprudently excluding and ignoring its intimate relationship with the mother

ingredient. This is illogical and smacks of dual standards.

China is annually importing 74 million tons of

soy seed and importing almost negligible volumes of soy oil. Last week EU has given

option to member countries to choose usage of biotech crops, which was hitherto

a complete prohibition. Inhibitions, even environmental, against bio tech crops

are vanishing fast vis-a vis their benefits. Indian isolation in this respect

is unwarranted.

Chart4

(Source—USDA)

Pending a final decision on the seeding

of GM crops by the Governments or Courts, the solution lies in permitting

import of oilseeds—GM or otherwise- freely by the actual users industry. The

industry shall produce edible oil and de-oiled cake (soybean meal etc.) both

for domestic and overseas consumption. For

example, India needs to import about 11 million tons of soy beans to bridge

this current gap of 2 million tons of soy oil (about 18% recovery) to

neutralise import that would provide 9 million tons (82%) of soymeal for

trading worldwide. There will be net

saving in hard currency by absence of import of expensive oils, export of soymeal

and domestic prices of soy oil will also converge with lower international

prices –and not reflect a disparity of 26% as explained above.

Solvent extraction industry may

set up port based plants for crushing beans with intent to export meal and sell

oil domestically—just as some sugar mills process raw sugar into refined sugar

at the west and east coast of India for export and local use. Domestic soy seed

prices will also align with international market. Soymeal will find perfect parity with markets

in the geographic arch spanning from Japan to EU. This is a win-win situation.

Let Niti Aayog think tank

demolish the traditional mind set and start with this transformation in the

agro-sector ================================================================================

No comments:

Post a Comment